The Centre for Medicines Research (CMR) International, a Clarivate business, publishes the Pharmaceutical R&D Factbook, an annual report designed to equip the Pharmaceutical R&D sector with a reliable quotable source of key reference metrics and predictions used to strengthen the planning and effectiveness of R&D. The just-published 2023 Factbook indicates an industry that is becoming more nimble and efficient in its R&D over the long haul.

R&D productivity fell in 2022, but late-phase cancellations are also trending down

The rise and fall of R&D productivity across the global biopharmaceutical industry is a well-documented and much discussed topic, with industry commentators quantifying productivity in many ways (e.g., forecast peak sales per asset versus the cost of developing an asset or an output measure such as the number of global first world launches).

The common thread in all these different metrics is that R&D productivity is measured as a function of an input – for example, R&D expenditure — versus an output, such as sales of newly launched products. In addition, R&D productivity analyses are in some way associated with actual or future launches or a consequence of the launch, such as resulting sales. So, a simple and obvious surrogate for R&D productivity, which considers an output component only, is the number of New Molecular Entities (NMEs) launched annually.

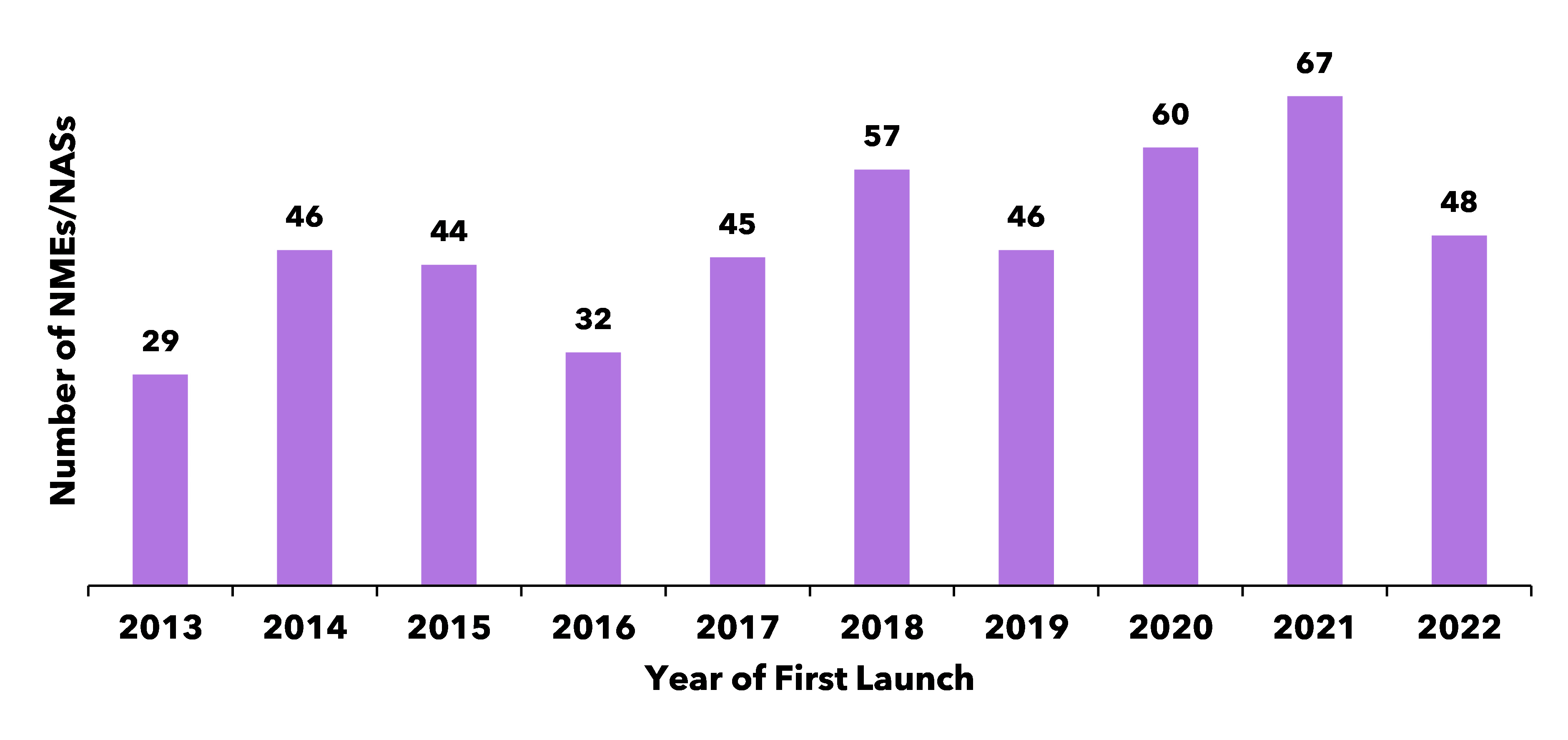

Figure 1 illustrates the trend in the number of NMEs first launched onto the world market between 2013 and 2022. Looking at NMEs launched globally in 2022 paints a gloomy picture at first sight, with a 28% drop from 2021 to 2022. While some industry observers read this drop as a clear decline in productivity, others take a more optimistic view, attributing the decline to FDA submission calendar fluctuations and noting that 2022 numbers were not very different from the ten-year average. In fact, the number of NMEs has grown by 65% between 2013 and 2022.

Figure 1: Number of NME launches from 2013 to 2022

Analyses from the 2023 R&D Factbook also indicate that the number of late phase terminations has consistently declined in recent years. Together, these trends paint a positive picture for the biopharmaceutical industry, suggesting that the industry is getting better at “doing more with less” and progressing only the more promising compounds, thereby improving productivity.

Spend is growing, but ROI is TBD

However, when looking at the potential commercial value of this R&D activity, some challenges remain.

R&D spend is steadily growing and is expected to reach approximately $200 billion by 2025. This amounts to approximately 20% of sales revenues which are reinvested into developing pipelines. However, only 10% of global biopharmaceutical sales were derived from products launched in the preceding five years, the rest of revenues coming from established products. CMR analysis suggests that this trend is likely to continue in the near term.

The industry is focusing on newer technologies and modalities to drive innovation, including cell and gene therapies, antibody drug conjugates, AI and machine learning, along with novel targets, predictive biomarkers and newer, more complicated study designs. However, their full impact on value remains to be realized.

Altogether, the data highlight an improvement in the volume of R&D productivity, while the value of this innovation remains uncertain.

The 2023 CMR International Pharmaceutical R&D Factbook features metrics and analyses on R&D productivity and many other key topics relevant to the biopharmaceutical industry, such as R&D resources and pipelines, patents and generic drugs. Learn more about purchasing it here.

For over 20 years, CMR International has been a trusted partner to the largest and most innovative pharmaceutical companies to help them assess R&D productivity and provide insights and decisions on industry trends. To learn more about how Clarivate and CMR International help pharmas future-proof their portfolios, please visit us here.

Jasmin Mehta is a Senior Manager within the Life Science Professional Services team at Clarivate. She has over 19 years of experience within Pharmaceutical R&D analytics and currently leads a broad array of assignments including Pharma R&D industry benchmarking, competitive landscape analysis and building business intelligence platforms within the R&D development space. She has extensive experience working with the business intelligence teams of leading pharmaceutical companies on topics such as R&D productivity , portfolio risk and protocol complexity. Prior to joining Clarivate, she has held a consulting role within the market research and data analytics team of a strategy consulting firm.

Jasmin has a Masters degree in Corporate Governance from Kingston University, London and a Bachelors degree in Economics and English Literature from the University of Mumbai.